fulton county ga sales tax rate 2021

Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next business day. Fulton County GA Sales Tax Rate.

New York Sales Tax Rates By City County 2022

To review the rules in.

. Georgia has a 4 sales tax and Fulton County collects an additional 3 so the minimum sales tax rate in Fulton County is 7 not including any city or special district taxes. The current total local sales tax rate in Fulton County GA is 7750The December 2020 total local sales tax rate was also 7750. 1 State Sales tax is 400.

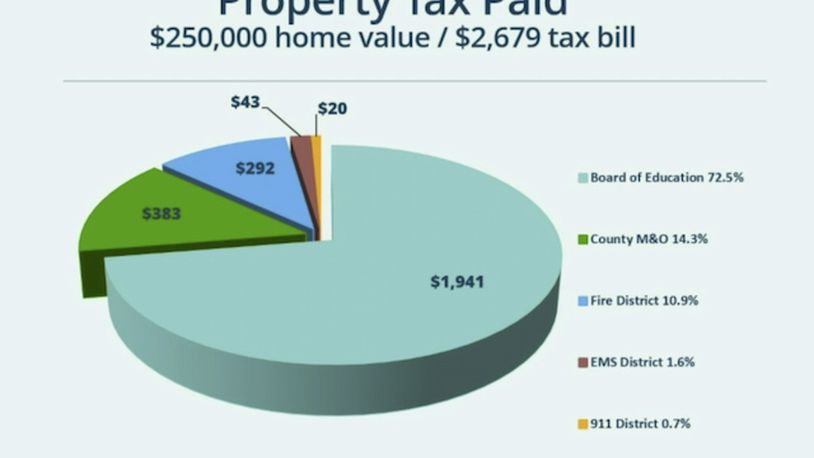

Property Taxes The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. The 1 MOST does not apply to sales of motor vehicles. February 262021 Rate Per Thousand Rate Per Thousand TOWN OF BLEECKER.

TAX RATE CHART 21-22. From 1997 through 2021 the tax raised almost 25 billion in revenue for county schools. This rate includes any state county city and local sales taxes.

A TAX SALE IS THE SALE OF A TAX LIEN BY A GOVERNMENTAL ENTITY FOR UNPAID PROPERTY TAXES BY THE PROPERTYS OWNER. Integrate Vertex seamlessly to the systems you already use. 4february 2021 sale list page of 5000 21800 21800 5000.

A tax sale is the sale of a Tax Lien by a governmental entity for unpaid property taxes by the propertys owner. Fulton County collects on average 108 of a propertys assessed fair market value as property tax. Ad Automate Standardize Taxability on Sales and Purchase Transactions.

The total 775 Fulton County sales tax rate is only applicable to businesses and sellers that are not in the Greater Atlanta area. Surplus Real Estate for Sale. 2020 Rate Per Thousandl.

The Tax Commissioner takes the appraised value and the exemption status provided by the Board. This table shows the total sales tax rates for all cities and towns in Fulton County including all. FULTON COUNTY COUNTY TOWN TAX RATES.

The minimum combined 2022 sales tax rate for Fulton County Georgia is. Sales is under. If your business is based in Atlanta or you sell to customers in Atlanta then the sales tax rate is 49.

The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state sales tax and 375 Fulton County local sales taxesThe local sales tax consists of a 300 county sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc. Estimated Combined Tax Rate 775 Estimated County Tax Rate 300 Estimated City Tax Rate 000 Estimated Special Tax Rate 075 and Vendor Discount 30-05 N. The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set.

48-5-311 e3B to review the appeal of assessments of property value or exemption denials. Due to renovations at the Fulton County Courthouse located at 136 Pryor. Sales Tax and Use Tax Rate of Zip Code 30350 is located in Atlanta City Fulton County Georgia State.

The Fulton County sales tax rate is. 2020 rates included for use while preparing your income tax deduction. Ad Lookup Sales Tax Rates For Free.

The Fulton County Board of Assessors reserves the right when circumstances warrant to take an additional 180 days pursuant to OCGA. Property Taxes The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. The latest sales tax rate for Union City GA.

Sales Tax and Use Tax Rate of Zip Code 30213 is located in Fairburn City Fulton County Georgia State. This coupled with the base rate of Georgia sales tax means the effective rate is 89. Atlanta GA 30303.

5 State Sales tax is 400. Estimated Combined Tax Rate 775 Estimated County Tax Rate 300 Estimated City Tax Rate 000 Estimated Special Tax Rate 075 and Vendor Discount 30-05 N. Fultons rate inside Atlanta is 3.

Atlanta GA 30303. Fulton County voters first approved the countys special purpose local option sales tax SPLOST for education in 1997. Interactive Tax Map Unlimited Use.

Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am. The total sales tax rate in any given location can be broken down into state county city and special district rates. The Georgia state sales tax rate is currently.

Voters renewed the tax for the fourth time in June 2017. 325 East Washington St Suite 250 Athens GA 30601. Has impacted many state nexus laws and sales tax collection requirements.

General Rate Chart - Effective July 1 2021 through September 30 2021 2208 KB General Rate Chart - Effective April 1 2021 through June 30 2021 219 KB General Rate Chart - Effective January 1 2021 through March 31 2021 4712 KB. Fulton County has one of the highest median property taxes in the United States and is ranked 220th of the 3143 counties in order of median property taxes. TOWN OF NORTHAMPTON COUNTY TAX.

Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next business day. Fulton County Georgia has a maximum sales tax rate of 89 and an approximate population of 973195. The median property tax in Fulton County Georgia is 2733 per year for a home worth the median value of 253100.

In Clayton County the tax rate for motor vehicle sales is 1 less than the generally applicable tax rate. 705 rows Georgia has state sales tax of 4 and allows local governments to collect a local. The 2018 United States Supreme Court decision in South Dakota v.

Sales is under. Inside the City of Atlanta in both DeKalb County and Fulton County the tax rate for motor vehicle sales is 1 less than the generally applicable tax rate. The Fulton County Sales Tax is collected by the merchant on all qualifying sales made within.

Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am.

The 10 Best Assisted Living Facilities In Stone Mountain Ga For 2022

Georgia Sales Tax Small Business Guide Truic

Fayette County Approves Rolled Back Tax Rate

Missouri Sales Tax Rates By City County 2022

Georgia Sales Tax Rates And Compliance

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Ohio Sales Tax Rate Changes In March 2022

Sales Taxes In The United States Taxable Itemsและcollection Payment And Tax Returns

Sales Tax On Grocery Items Taxjar

What Is The Fulton County Sales Tax The Base Rate In Georgia Is 4

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Georgia Sales Tax Guide For Businesses

Atlanta Georgia S Sales Tax Rate Is 8 9

Georgia Property Tax Calculator Smartasset

Georgia Sales Tax Exemptions Agile Consulting Group

What Is The Sales Tax Rate In Richmond County Ga Cubetoronto Com